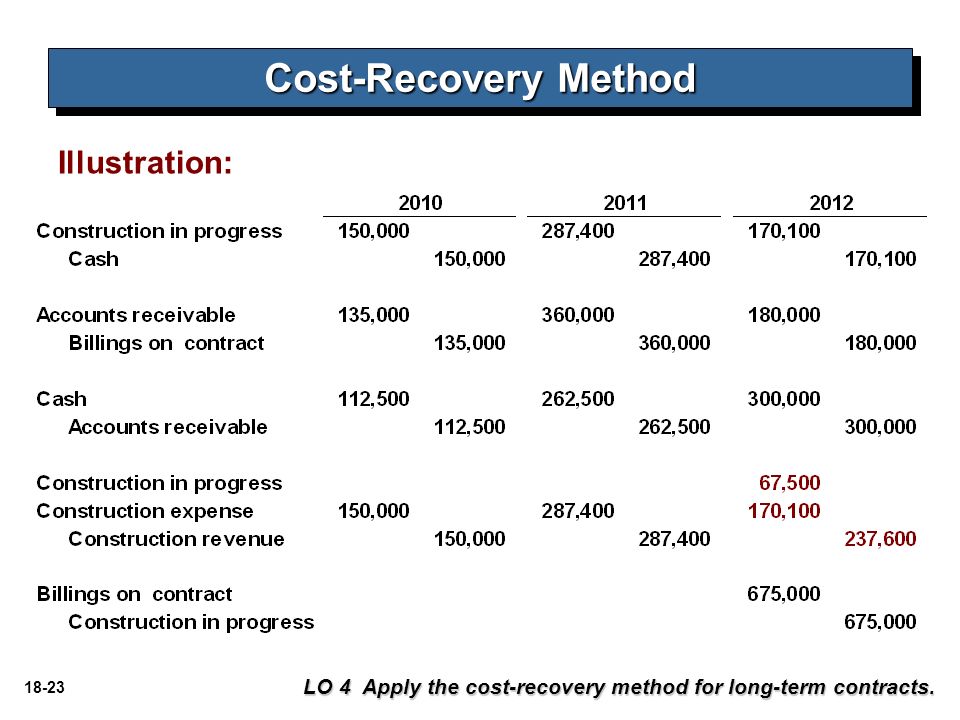

Cost Recovery Method Example Journal Entries

The cost recovery method is a way of recognizing and classifying revenue in accounting. The inventory cost Foster 120000.

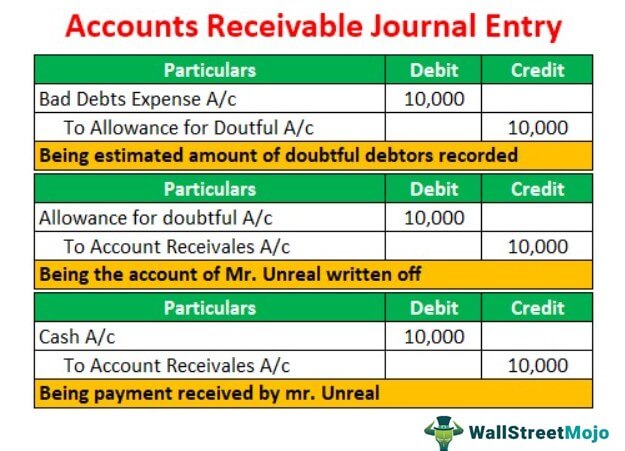

Change In Bad Debts Allowance And Subsequent Recovery Of Bad Debts Financiopedia

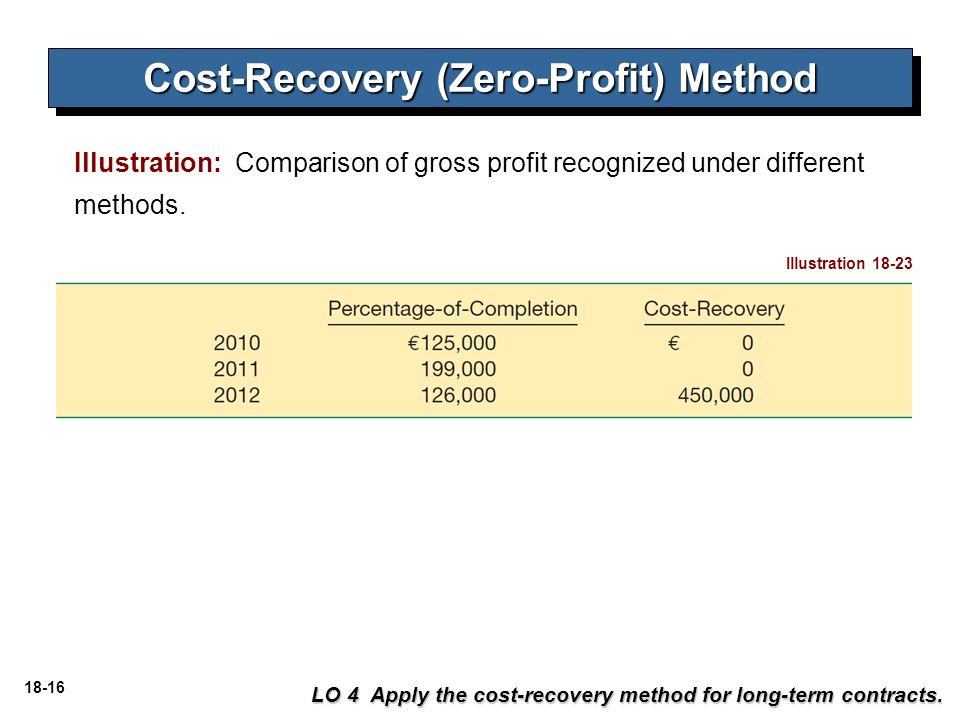

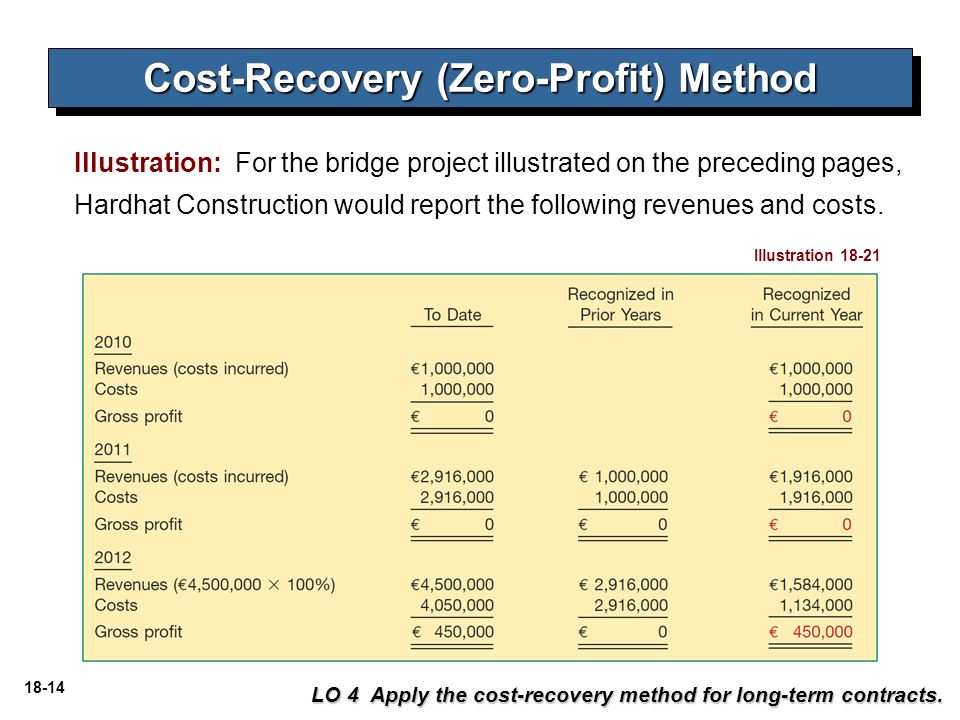

On 1 January 2011 it won a 3-year contract to construct an intra-city dedicated bus tracks for a total price of 300 million.

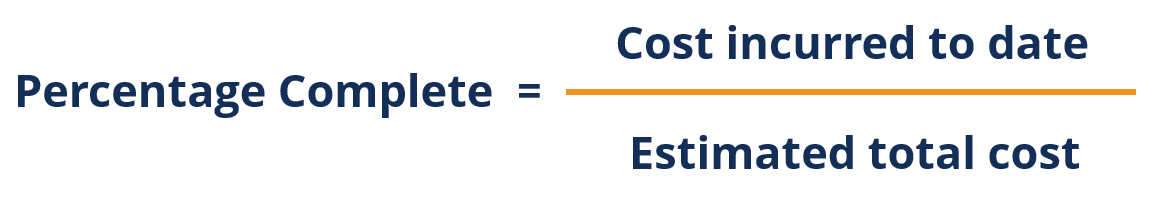

Cost recovery method example journal entries. Real Estate Sales ASC 360. The above example shows that the by-products estimated value at split-off point is obtained by deducting the estimated gross profit and production cost after split-off point from the ultimate market value of the by-product. If a company isnt reasonably assured of recovering the cost of the goods sold if the buyer defaults on the financing arrangement the sales transaction records it using the cost-recovery method.

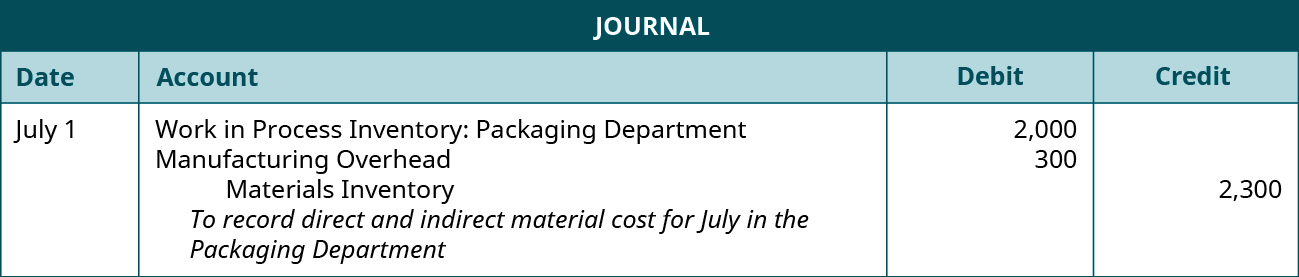

SFAS 66 October 1982. The total job cost of Job 106 is 27950 for the total work done on the job including costs in beginning Work in Process Inventory on July 1 and costs added during July. Prepare the necessary journal entries for 2016 and 2017 assuming revenue recognition upon delivery.

To calculate depreciation by month. Under the cost-recovery. Accounting for installment sales include the following steps.

1950 12 16250. 2500 x 612 1250 To record the journal entry for 2015 prior to the disposal of the asset the 1250 would debit the depreciation expense and credit the accumulated depreciation account for 1250. Following is a summary of the costs incurred amounts billed and amounts collected.

Cost recovery method is a very useful tool of accounting to earn and record your revenueCost recovery method journal entries Cost recovery method to calcul. In addition deferred gross profit is reduced. Is a diverse construction group.

We will only make one journal entry at first. The first year depreciation calculation would be. Repeat requirement 1 applying the cost recovery method.

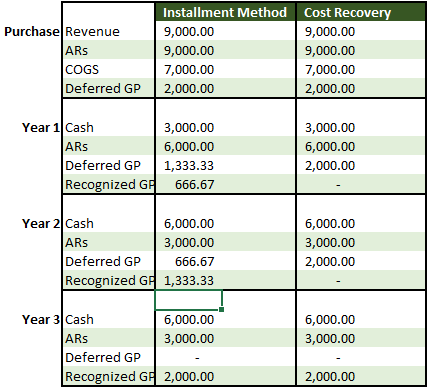

Repeat requirement 1 applying the installment sales method. At the time of sale recognize the revenue and related cost of goods sold. It differs from cost recovery method because in installment method there is less doubt about collectability of the installments.

The cost to Hammer for the jack hammer was 1875. The installment-sale method isnt exactly an optimal way of recording sales transactions and the cost-recovery method takes it down another notch. When using the cost recovery method a business doesnt record income related to the sale of its services until the money collected from a client exceeds the cost of the services rendered.

Hammer Industries sells a jack hammer to a customer on 1231X1 who has a questionable history of making payments in a timely manner. Revenue and cost of goods sold are recognized as each installment payment is made. Let us assume that a car costs 10000 on credit by owing money next month.

Since the asset is recorded on the debit side and the car is an asset money owed in credit is a liability and falls on the credit side. 3 6 x 3900 1950. You might also hear the cost recovery method referred to as the.

Defer the gross profit on the sale. An interpretation of FASB Statement No. The company uses the perpetual inventory system.

The yearly expense amount of 2500 would simply be multiplied by 6 months out of 12 to come up with the adjusted expense amount of 1250. Your sum-of-the years depreciation. The following example illustrates the market value or reversal cost method of costing by products.

Example of the Cost Recovery Method. Example and Journal Entries. For example if Cowen distributed a 10 stock dividend in February Brewer which held 1000 shares at a cost of 14400 or 1440 per share would receive another 100 shares and would then hold 1100 shares at a cost per share of 1309 computed as 144001100 shares.

Debit Accounts Receivable for 300000 credit Inventory for 180000 and credit Deferred Gross Profit for 120000. February 10 2018 accta. FASB Interpretation FIN 43 June 1999.

Accounting for Sales of Real Estates. The sale price is 2500. This entry records the completion of Job 106 by moving the total cost FROM work in process inventory TO finished goods inventory.

The purchase of a car on credit is an example of an accounting transaction. 1 2 3 6. After the entire cost of goods sold has been recovered recognize all remaining cash receipts as profit.

Cost Recovery Method Definition Examples When To Use This Method

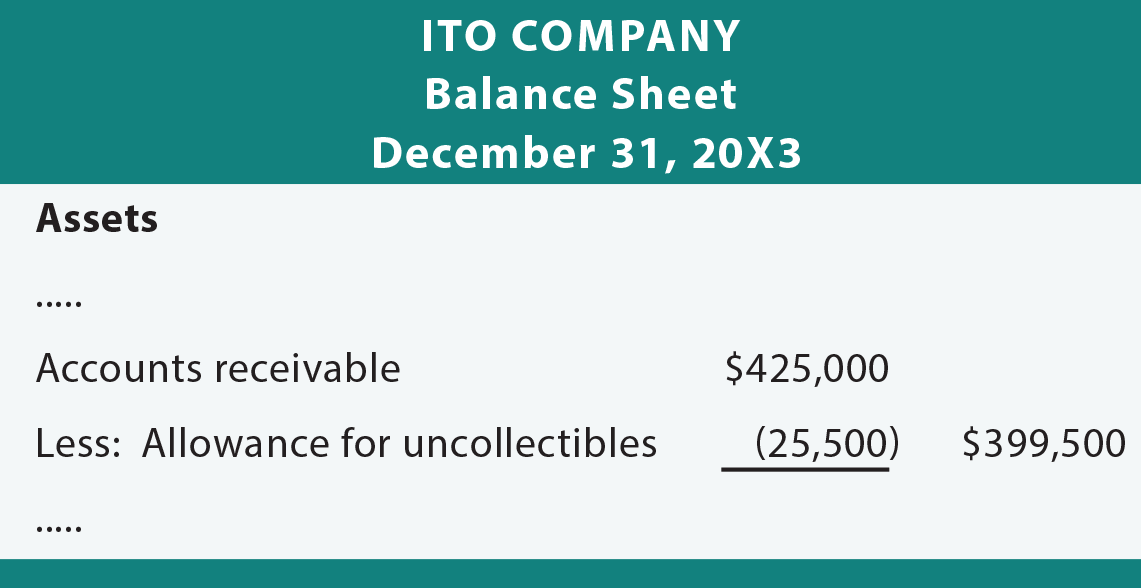

Accounts Receivable Journal Entries Examples Bad Debt Allowance

Prepare Journal Entries For A Process Costing System Principles Of Accounting Volume 2 Managerial Accounting

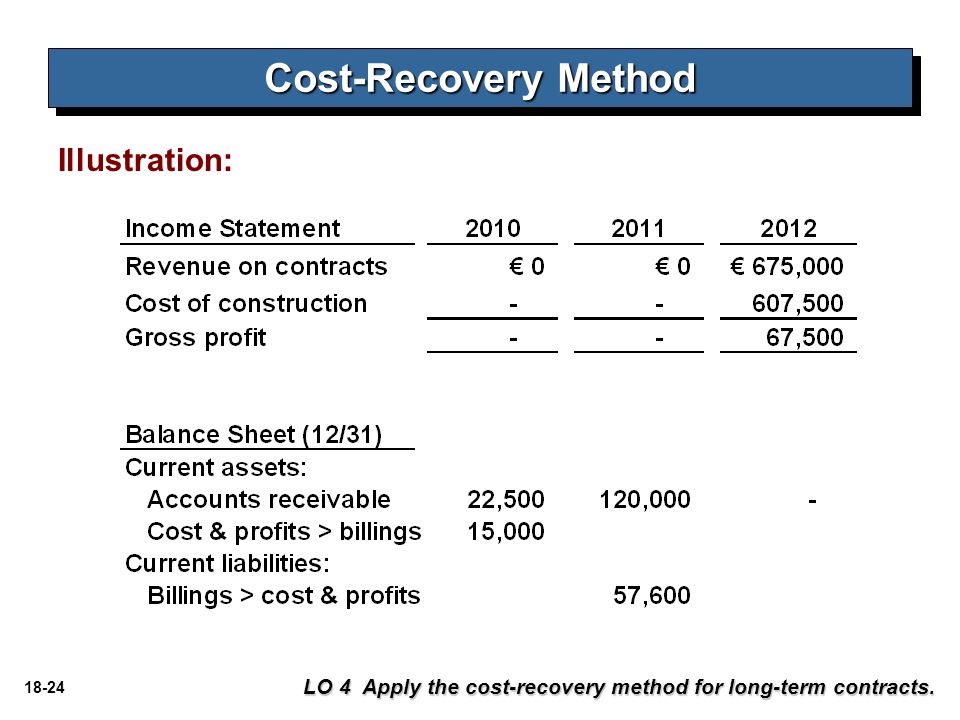

Long Term Contracts Construction Ppt Video Online Download

Cost Model In Accounting Definition Ias 16 Ifrs Us Gaap Journal Entries Depreciation Example

Writing Off An Account Under The Allowance Method Accountingcoach

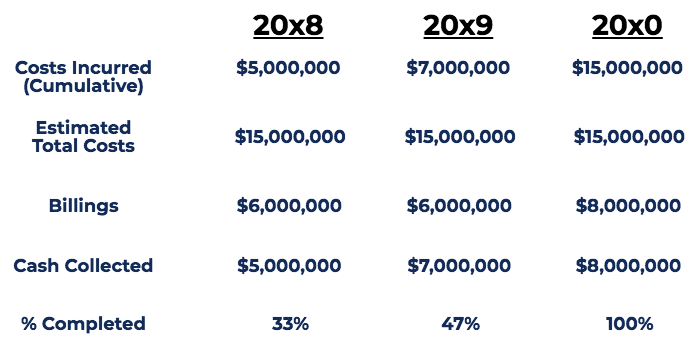

Percentage Of Completion Method Definition And Examples

Long Term Contracts Construction Ppt Video Online Download

Writing Off An Account Under The Allowance Method Accountingcoach

Percentage Of Completion Method Definition And Examples

A Small Business Guide To Cost Recovery The Blueprint

Writing Off An Account Under The Allowance Method Accountingcoach

Journal Entries For Retirements And Reinstatements Oracle Assets Help

Percentage Of Completion Method Definition And Examples

Long Term Contracts Construction Ppt Video Online Download

Long Term Contracts Construction Ppt Video Online Download

Allowance Method For Uncollectibles Principlesofaccounting Com

Journal Entries For Retirements And Reinstatements Oracle Assets Help

Unadjusted Trial Balance Format Uses Steps And Example

Post a Comment for "Cost Recovery Method Example Journal Entries"